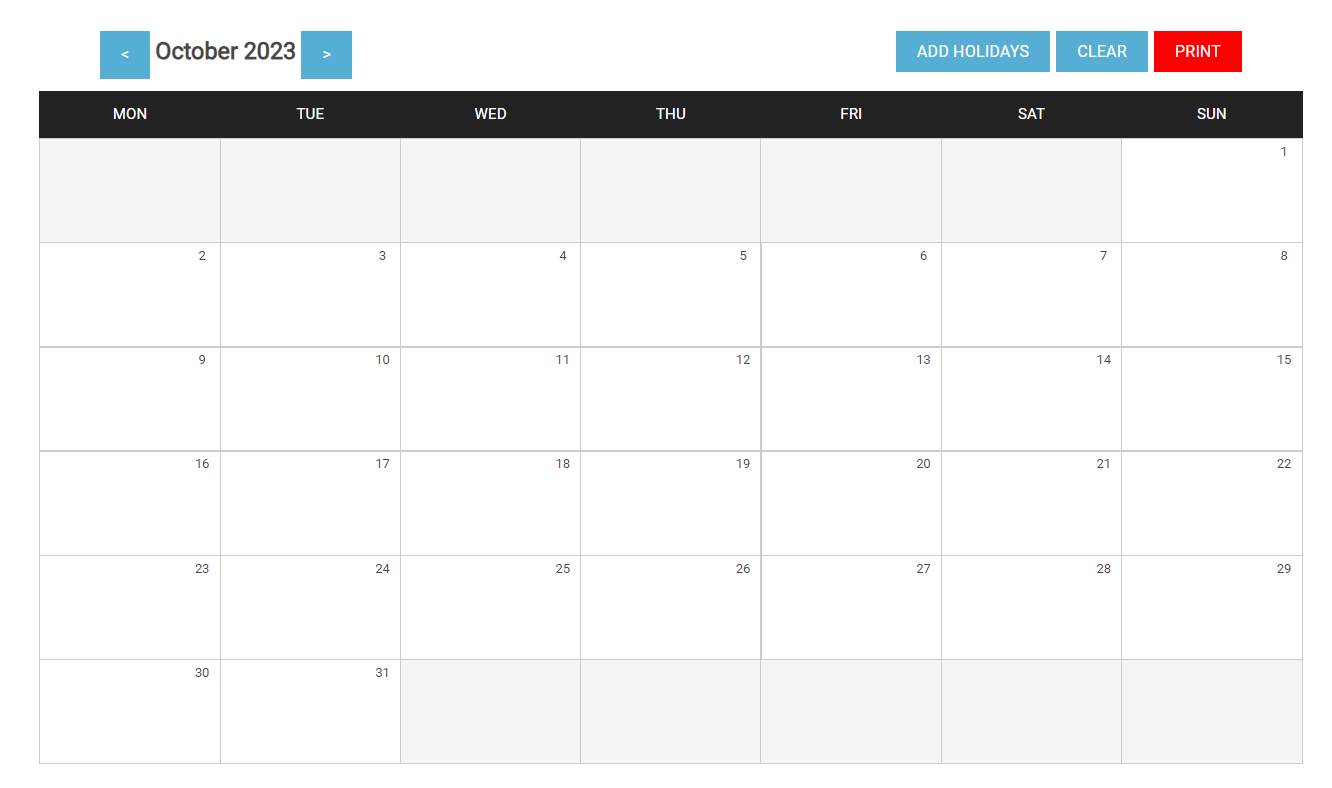

- TDS payment for the month of September – 2023 – 7th October 2023.

- GSTR -1 for the month of September 2023 – 11th October 2023.**

- EPF – Payment and Electronic Challan & Return (ECR) for the month of September – 2023 – 15th October 2023.

- ESIC payment and ECR – for the month of September – 2023 – 15th October 2023.

- PT payment and monthly return – September – 2023 – 20th October 2023.

- GST Payment and GSTR – 3B for the month of September – 2023 – 20th October 2023.**

- LLP Form – 8 for the FY – 2022-23 – 30th October 2023.

- eTDS return for the quarter ending 30th September 2023 – 31st October 2023.

- MSME – Form – I – April – 2023 to September – 2023 – 31st October 2023.

- Due date for filing of return of income for the assessment year 2023-24 if the assessee (not having any international or specified domestic transaction) is (a) corporate-assessee or (b) non-corporate assessee (whose books of account are required to be audited) or (c)partner of a firm whose accounts are required to be audited or the spouse of such partner if the provisions of section 5A apply – 31st October 2023.

Note: The due date of furnishing of Return of Income in Form ITR-7 in the case of assessees referred to in clause (a) of Explanation 2 to section 139(1) has been extended from October 31, 2023 to November 30, 2023, vide Circular no. 16/2023, dated 18-09-2023.

- Audit report under section 44AB for the assessment year 2023-24 in the case of an assessee who is also required to submit a report pertaining to international or specified domestic transactions under section 92E – 31st October 2023.

* Updated as of 2nd October 2023.

** Please keep in touch with your tax consultant / adviser for any further clarification.

*** This document is issued in the general interest of knowledge transfer purpose and it cannot be construed in any other manner whatsoever.